Breathtaking Tips About How To Apply For A Itin

Authorize work in the u.s.

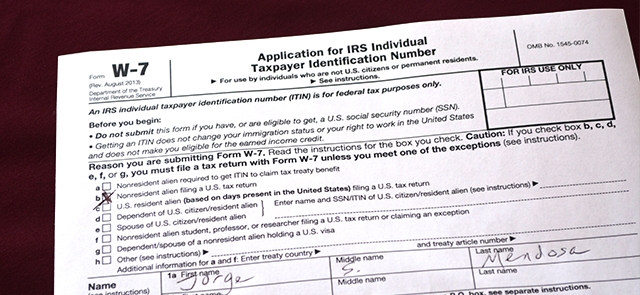

How to apply for a itin. For information on obtaining an itin abroad, please refer. You will apply for your itin by. All other visa types should work with the uw tax office to obtain the documentation needed to apply for an itin.

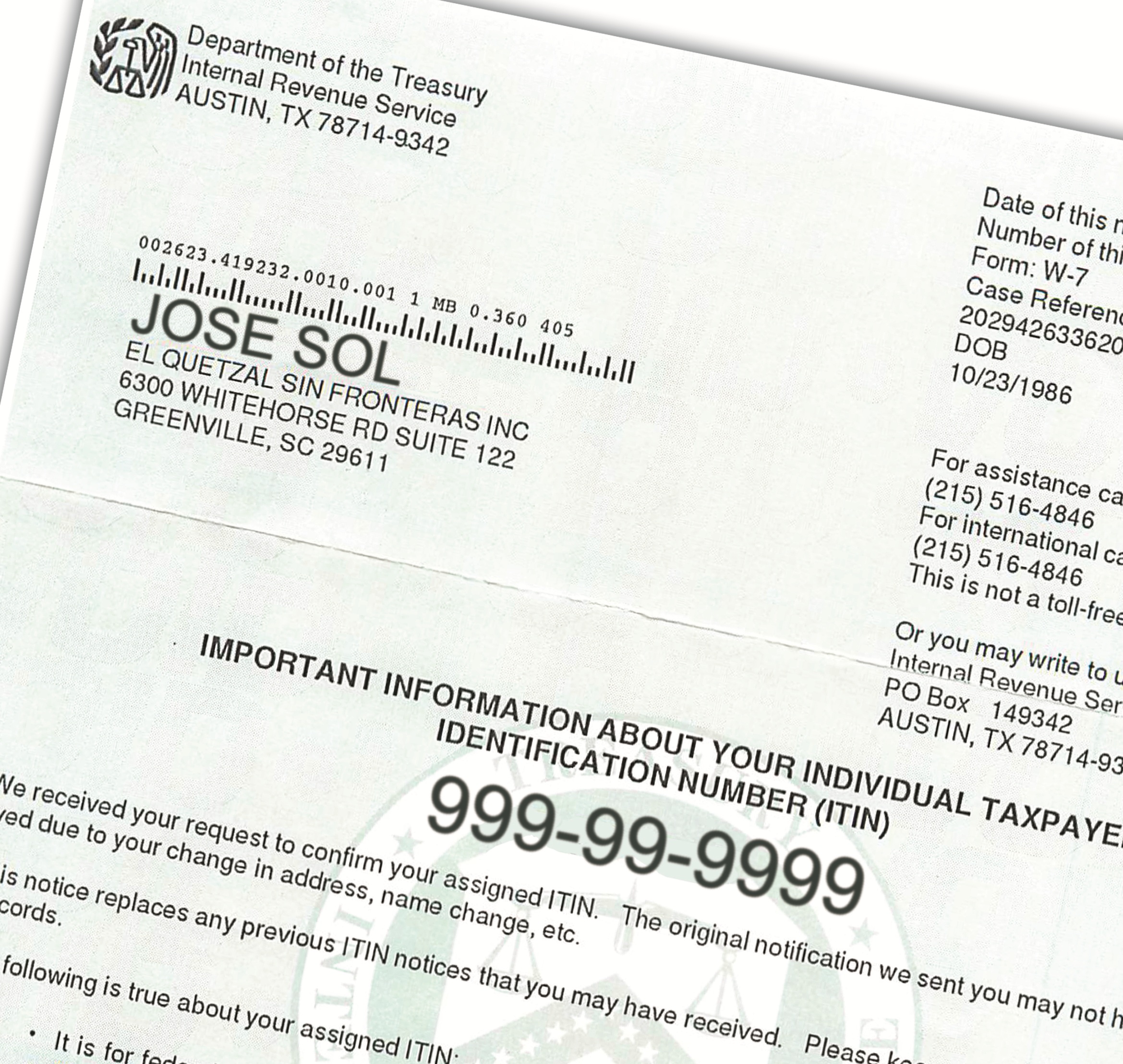

If you’re working and earning money in the united states, but you don’t have and don’t qualify for a social security number, you’ll need an itin. You can apply for an itin tax id for you, your spouse, and your dependents when you prepare your tax return with us. Here’s what an itin can help you do.

Applying for and using an itin. If you are unable to apply for an ssn, foreign national students on an f or j visa type should apply for an individual taxpayer identification number (itin). Provide eligibility for social security benefits.

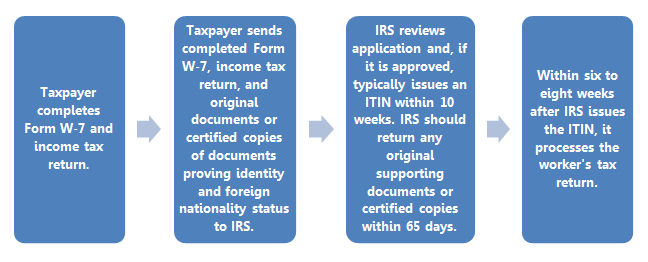

Once you turn in your application and qualify, the average time it takes for the irs to send you your itin number through the mail is six weeks. Get itin number quickly through a caa. Moving outside of the tax season, applying through a caa under normal circumstances, it takes between 3 to 4 weeks.

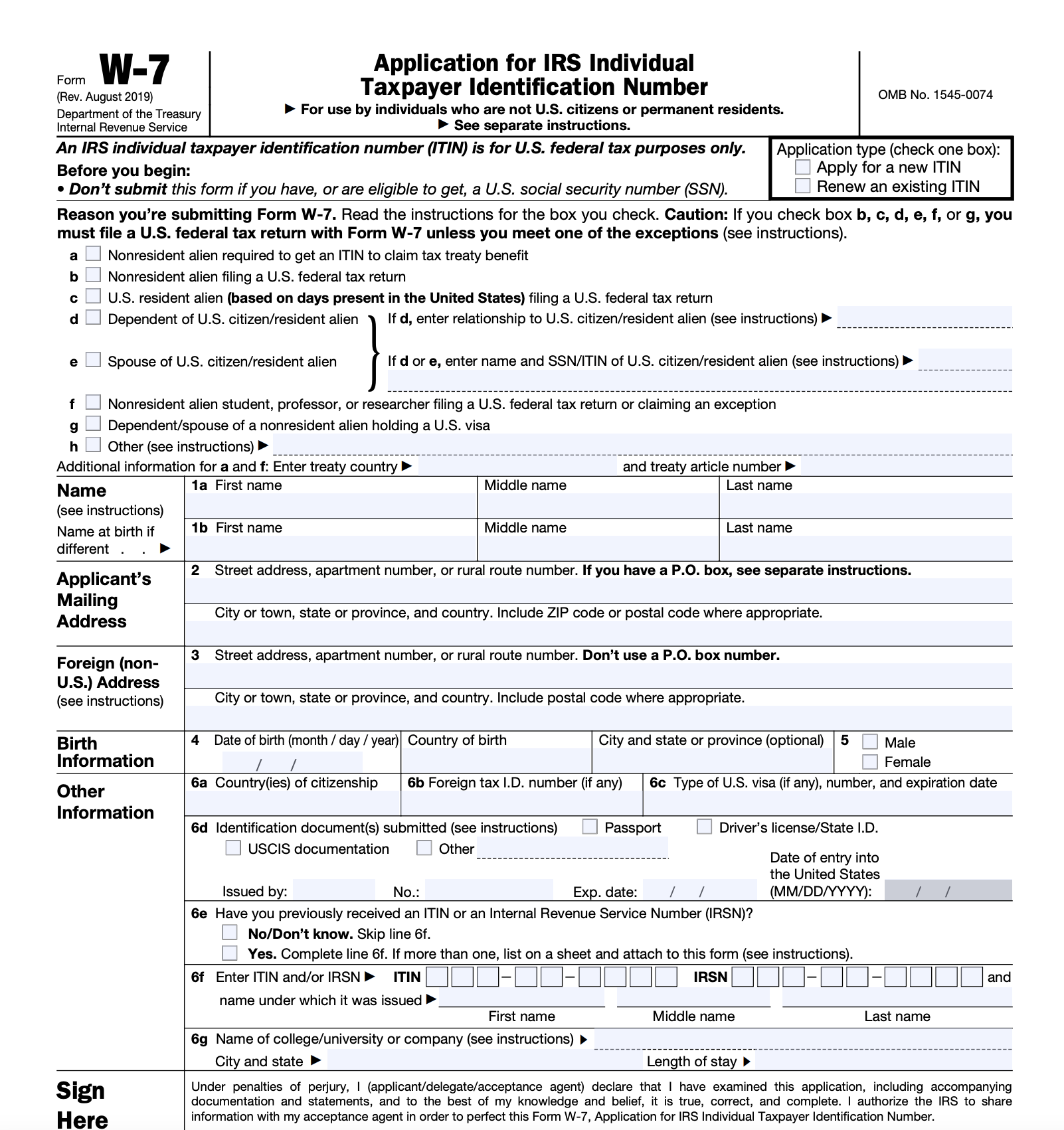

You can submit your application in person or by mail. Individuals must have a filing requirement and file a valid federal income tax return to receive an itin, unless they meet an exception. An itin is required to file taxes if you are.

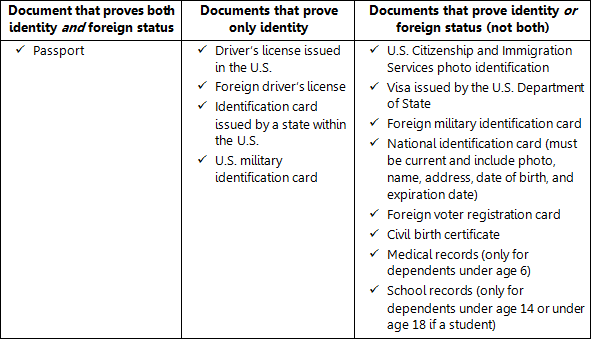

After receiving your social security number or itin… 1. If you’re trying to apply for a new itin, you need one identification documentation and two supporting documentation. How to apply for a new itin.